As higher education becomes increasingly integral to career aspirations, the burden of student loan debt has emerged as a formidable challenge for many. The dream of a college education often comes hand-in-hand with the financial reality of loans.

This exploration delves into the complex landscape of student loan debt, examining its origins, the impact on individuals and society, and proposing strategies for navigating this multifaceted challenge.

1. The Rise of Student Loan Debt

The student loan debt crisis has reached unprecedented levels, fueled by the rising costs of education. In the United States, outstanding student loan debt has surpassed $1.5 trillion, affecting millions of graduates and shaping the financial landscape for an entire generation.

Understanding the roots of this crisis is essential to devising effective solutions.

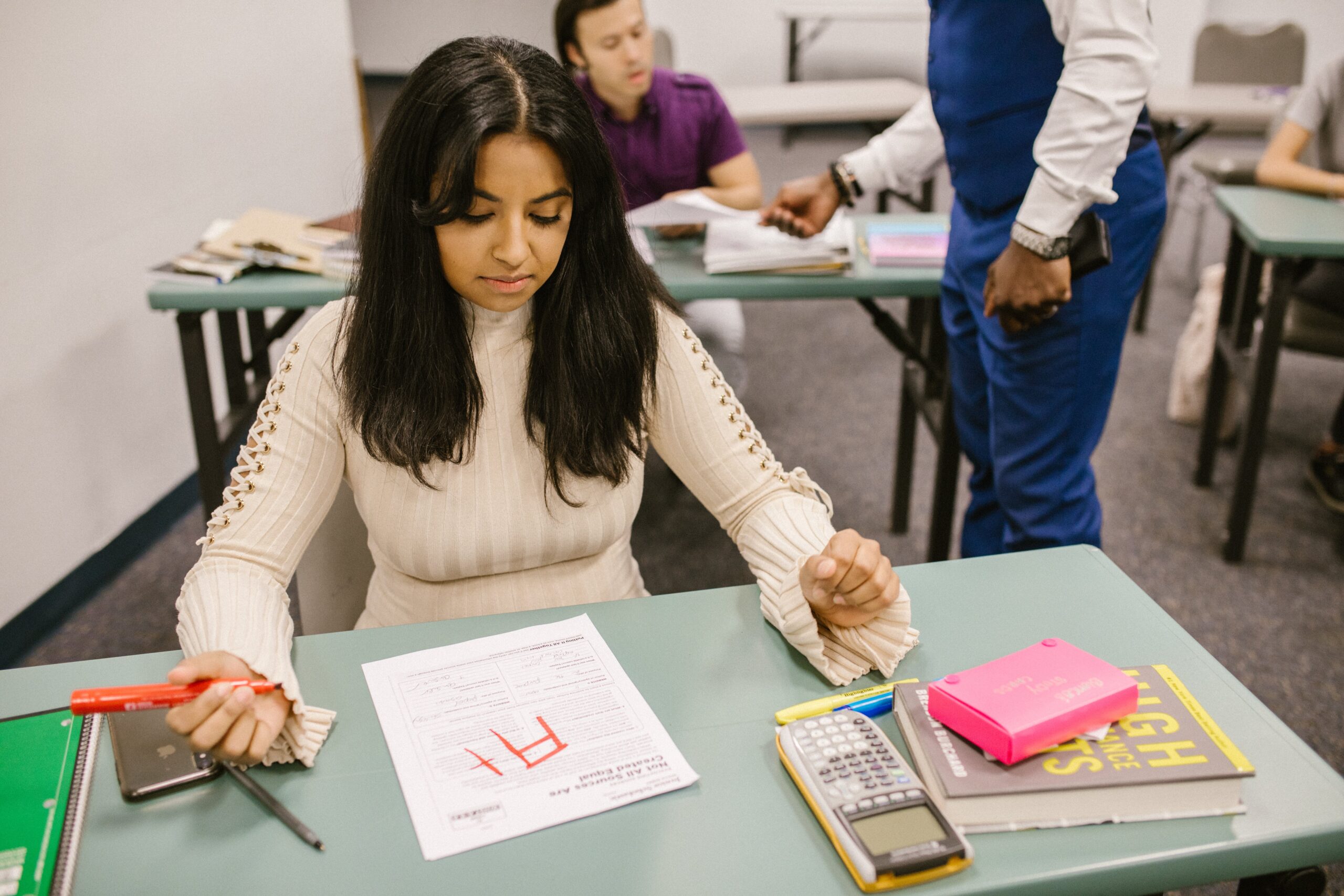

2. The Cost of Education

The escalating cost of education is a primary driver of the student loan debt challenge. Tuition fees, coupled with the rising expenses of housing, textbooks, and other ancillary costs, create a financial burden that often requires students to seek loans to pursue their academic aspirations.

Examining the factors contributing to these rising costs is crucial for implementing meaningful reforms.

3. Impact on Graduates

For graduates, student loan debt can cast a long shadow over their early professional years. Monthly loan payments may strain budgets, delaying significant life milestones such as homeownership, marriage, and starting a family. The psychological impact of carrying substantial debt affects not only financial stability but also mental well-being.

4. Economic Implications

The macroeconomic repercussions of widespread student loan debt are profound. Graduates burdened with substantial debt may be less likely to contribute to economic growth through spending and investment.

The ripple effects extend to various sectors, influencing housing markets, consumer spending patterns, and even the overall stability of the financial system.

5. Variability in Repayment Options

Navigating student loan debt requires an understanding of the diverse repayment options available. Federal loans offer income-driven repayment plans, forgiveness programs, and deferment options.

Private loans, however, may have fewer flexible repayment choices, potentially creating a more challenging financial landscape for borrowers.

6. Loan Forgiveness Programs

Exploring loan forgiveness programs is a critical aspect of managing student loan debt. Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness are examples of initiatives aimed at easing the financial burden for individuals pursuing careers in public service or education.

Awareness and eligibility criteria for these programs play a pivotal role in their effectiveness.

7. The Role of Interest Rates

Interest rates significantly impact the total repayment amount and the duration of loan repayment. Understanding the nuances of fixed versus variable interest rates, refinancing options, and the potential implications of interest accrual during deferment or forbearance is vital for borrowers seeking to optimize their repayment strategies.

8. Financial Literacy and Education

Empowering students with financial literacy education is a proactive approach to mitigating the impact of student loan debt.

Educating borrowers about interest rates, loan terms, and responsible financial management equips them with the knowledge to make informed decisions about their education financing.

9. Government Policies and Reforms

Addressing the student loan debt challenge necessitates comprehensive government policies and reforms. This includes reconsidering the cost structure of higher education, exploring tuition-free or subsidized education models, and evaluating the feasibility of widespread debt cancellation initiatives. The political landscape and public discourse play crucial roles in shaping the trajectory of these reforms.

10. Employer-Sponsored Repayment Programs

Innovative solutions are emerging in the form of employer-sponsored repayment programs. Some companies recognize the impact of student loan debt on their employees and are implementing initiatives to assist with repayment.

Exploring the potential expansion of such programs can provide relief for borrowers navigating the challenges of student loan debt.

11. Community and Nonprofit Initiatives

Community and nonprofit organizations are stepping up to address the student loan debt challenge. From offering financial counseling services to advocating for policy changes, these initiatives play a crucial role in supporting individuals burdened by student loans. Collaboration between these organizations, educational institutions, and policymakers is essential for fostering holistic solutions.

12. Personal Financial Planning

On an individual level, strategic financial planning is a powerful tool for managing student loan debt. Creating a budget, prioritizing repayment, exploring opportunities for additional income, and seeking professional financial advice are proactive steps individuals can take to navigate the complexities of student loan repayment.

13. Mental Health and Student Loan Debt

The emotional toll of student loan debt should not be underestimated. Mental health challenges, including stress, anxiety, and depression, are common among borrowers. Recognizing the intersection of financial and mental well-being is integral to developing holistic support systems for individuals grappling with the burden of student loans.

14. Global Perspectives on Student Loan Debt

While the student loan debt challenge is prominently discussed in the context of the United States, global perspectives offer insights into diverse approaches to higher education financing. Examining successful models from countries with lower student debt burdens can inform potential strategies and reforms.

15. Conclusion: Charting a Path Forward

In conclusion, navigating the student loan debt challenge requires a multifaceted approach that addresses the systemic issues contributing to the crisis. From policy reforms and innovative financing models to individual financial literacy and mental health support, each component plays a vital role in mitigating the impact of student loan debt on individuals and society.

As we collectively grapple with this challenge, the imperative is not only to alleviate the burdens of the present but to envision and enact systemic changes that prevent the recurrence of such financial challenges for future generations.

The journey toward effective solutions requires collaboration, innovation, and a shared commitment to fostering an educational landscape that empowers rather than burdens the pursuit of knowledge and professional growth.